Explain Different Methods of Calculating Depreciation

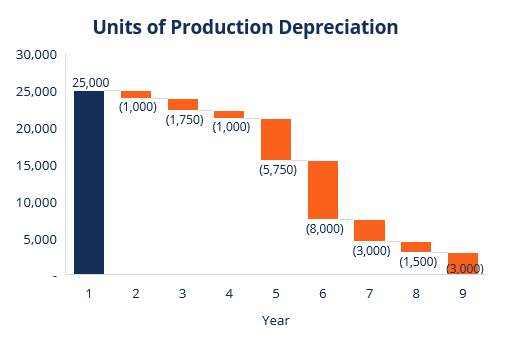

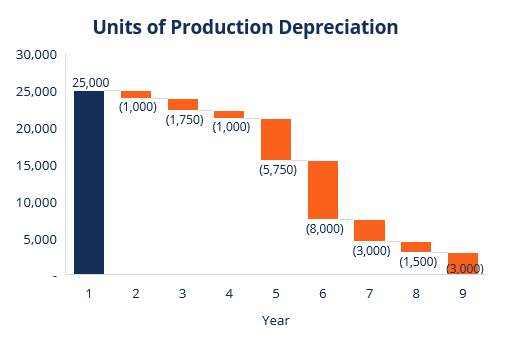

260000 beginning value of asset. Units of Production Method.

Depreciation Methods 4 Types Of Depreciation You Must Know

Common methods of depreciation are as follows.

. Written Down Value Method. Beginning value of asset x Depreciation rate Depreciation expense. The depreciation method chosen should be appropriate to the asset type its expected business use its estimated useful life and the assets residual value.

The depreciation rate is calculated by dividing the cost of the asset by the estimated quantity of product likely to be available. Impact of using different depreciation methods The total amount of depreciation charged over an assets entire useful life ie. Various methods are used by the companies to calculate depreciation.

A depreciation method commonly used to calculate depreciation expense is the straight line method. The depreciation formula is Depreciation Expense Cost Salvage Value Useful Life 2. Straight-line depreciationStraight Line DepreciationStraight line depreciation is the most commonly used and easiest method for allocating depreciation of an asset.

Straight Line Method SLM Under the depreciation Straight Line Method a fixed depreciation amount is charged annually during the lifetime of an asset. The types of depreciation calculation owing to its methods are indicated below. These are as follows.

Declining balance is an accelerated deprecation method. Depreciation Cost of asset Residual Value x Present value of 1 at sinking fund tables for the given rate of interest. This is the most commonly used method for calculating depreciation.

Depreciable amount is the same irrespective of the choice of depreciation method. Depreciation isnt part of the whole equation for figuring the fair market value which is the amount of money the company may fetch when it sells any of the assets. Method of calculating depreciation are as follows.

Straight-line depreciation is the most simple and commonly used depreciation method. Thus RMDY 1055 01818 First years depreciation is 01818 X 490000 89090 Second years depreciation is 955 016363 X 490000 80181. Your intermediate accounting textbook discusses a few different methods of depreciation.

Depletion Method This method is usually used in case of the wasting assets like mines oil wells quarries etc. Reducing balance depreciation changes the amount of depreciation charged over time. 260000 x 25 65000.

The advantage of using the straight line method involves the ease of calculating the annual depreciation amount. Straight-line declining-balance and sum-of-the-years digits. For example If a mine has 2 lakh tons of coal and the value of mine is 5 lakhs each ton of coal will cost 250.

Annual depreciation will be the quantity extracted multiplied by the rate per unit. Calculate the total depreciation of actual units produced. Reducing balance depreciation method.

Straight-line Units of production Sum of the years digits Declining balance Double-declining balance Straight-Line Depreciation Method Straight-line depreciation method is the depreciation method that spread the cost of assets evenly over the useful life of the assets. In straight line method it is assumed that the property loses its value by the same amount every year. Straight-Line Depreciation The straight-line method charges the same amount of depreciation to expense in every reporting period.

Different Depreciation Methods With Examples Straight Line Method. Per unit Depreciation Asset cost Residual value Useful life in units of production Step 2. The amount reduces both the assets value and the accounting periods income.

Method of calculating depreciation. The depreciation calculations are done as follows. The amount of annual depreciation is computed on Original Cost and it remains fixed from year to year.

In order to calculate the value the difference between the assets cost and the expected salvage value is. Depreciation x Actual output during the year units Machine hour rate or Service hours Method. Methods of Calculating Depreciation.

The five types of depreciation method that are commonly seen include. Various Depreciation Methods Straight Line Depreciation Method Diminishing Balance Method Sum of Years Digits Method Double Declining Balance Method Sinking Fund Method Annuity Method Insurance Policy Method Discounted Cash Flow Method Use Based Method. The straight-line method of depreciation is the most simple and easy to use depreciation method.

The written down value method also known as diminishing balance method or reducing balance. 500000 cost - 10000 salvage 490000 1 2 3 4 5 6 7 8 9 10 55 Remaining life of year one is ten. This method is also known as the Original Cost method or Fixed Instalment.

The straight line method involves determining the cost to depreciate and dividing that amount by the number of years the company expects to use the asset. The straight-line method is a depreciation method where the assets of the company are depreciated. There are five methods of Depreciation such as.

Calculate per unit depreciation. Total Depreciation Expense Per Unit Depreciation Units Produced. Straight-line method Unit of Production Method Reducing balancing method Double declining balance method Sum-of the years Digits method.

The annuity method of. The four main depreciation methods Straight-line depreciation method. Three are based on time.

Straight-Line Method In case of straight-line depreciation calculation the amount of expense is the same for each year of the asset lifespan. In straight-line depreciation the expense amount is the s. With the straight lineis a very common and the simplest method of calculating depreciation expense.

The following are the general methods of depreciation available for use. Finally calculate the value of the asset at the end of year one. There are several methods of depreciation which can result in differing charges to expense in any given reporting period.

Depreciation Definition Types Of Its Methods With Impact On Net Income

Depreciation Methods 4 Types Of Depreciation You Must Know

No comments for "Explain Different Methods of Calculating Depreciation"

Post a Comment